South Dakota offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable Energy

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

South Dakota State Capitol

500 E Capitol Ave,

Pierre, SD 57501

Phone: (605) 773-3688

fax: (605) 773-3887

Hours: M-F 8:00am-5:00pm

NorthWestern Energy

3210 Douglas Ave,

Yankton, SD 57078

(800) 245-6977

Hours: M-F 8:00am-5:00pm

Energy Division

South Dakota Energy Management Office

523 E Capitol Ave,

Pierre, SD 57501-3182

Phone: (605) 773-5981

Fax: 605-773-5980

Email: [email protected]

Sioux Falls Weather Bureau

26 Weather Lane

Sioux Falls, SD 57104-0198

Phone: (605) 330-4247

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Property Tax Exemption | Approx. $50,000 or 70% assessed value | Solar panels or batteries that are 5 megawatts or less |

| Residential Electric Vehicle Rebate | Approx. $500 | Black Hills Energy customers who purchase and install level 2 EV charger |

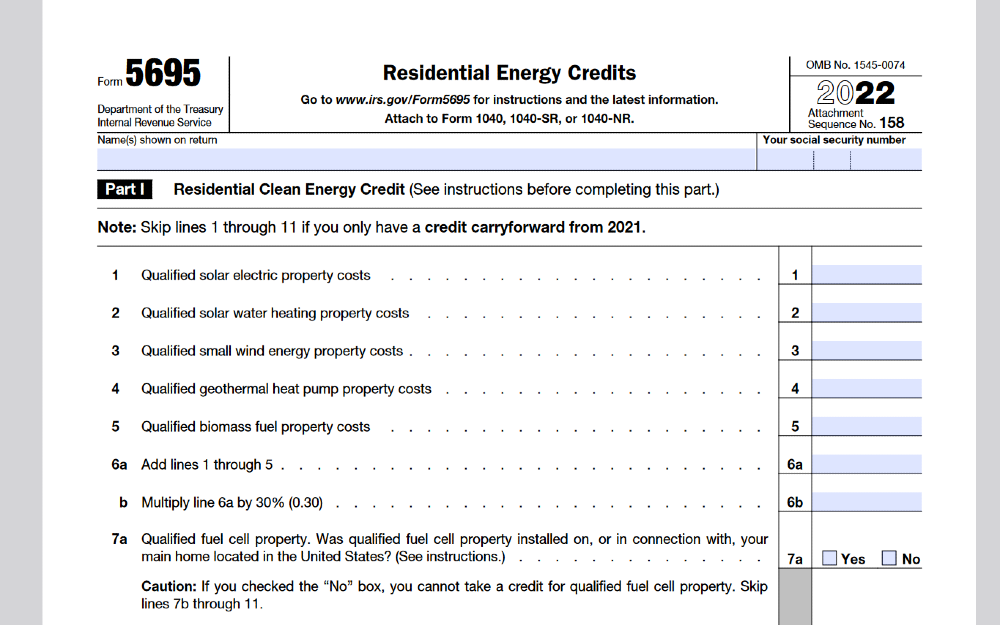

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

South Dakota Clean Energy

Renewable Energy Tax Incentives

Electric Laws, EV Charging, Solar FAQ

Solar Energy

Energy Assistance

Laws and Incentives

Power Outage Map

South Dakota Statewide Energy Management

Chris Gukeisen, P.E.

Joe Foss Building

523 E Capitol Avenue

Pierre, SD 57501-3182

ph: 605-773-5981

fax: 605-773-5980

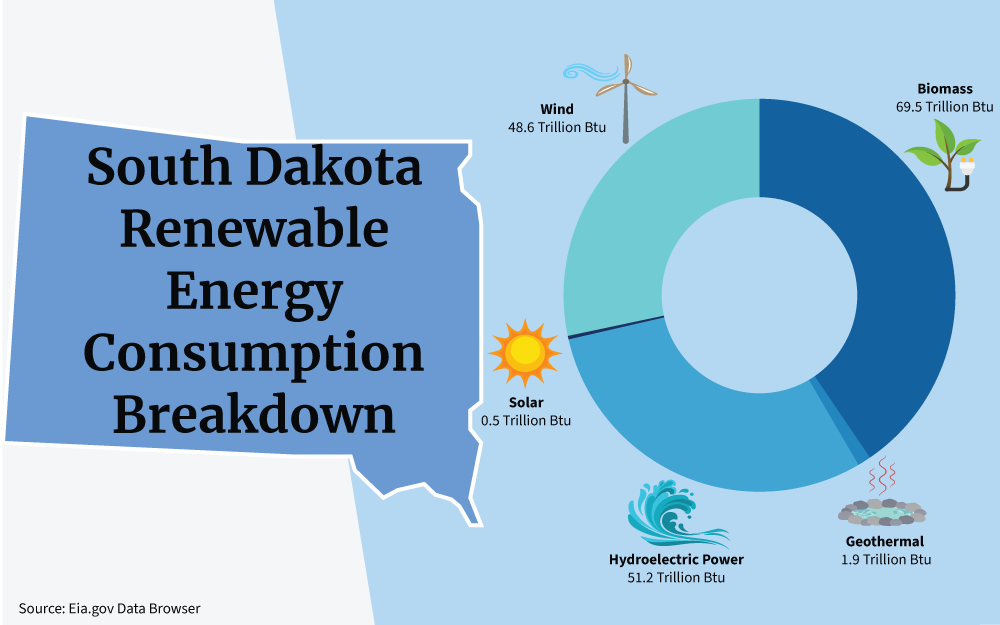

South Dakota Solar Energy Background

Solar energy in South Dakota can produce real Return On Investment (ROI) in due time with the help of South Dakota solar incentives.

In fact, there are grants and loans available for rural installation, and other South Dakota solar incentives for residential property owners.1, 2

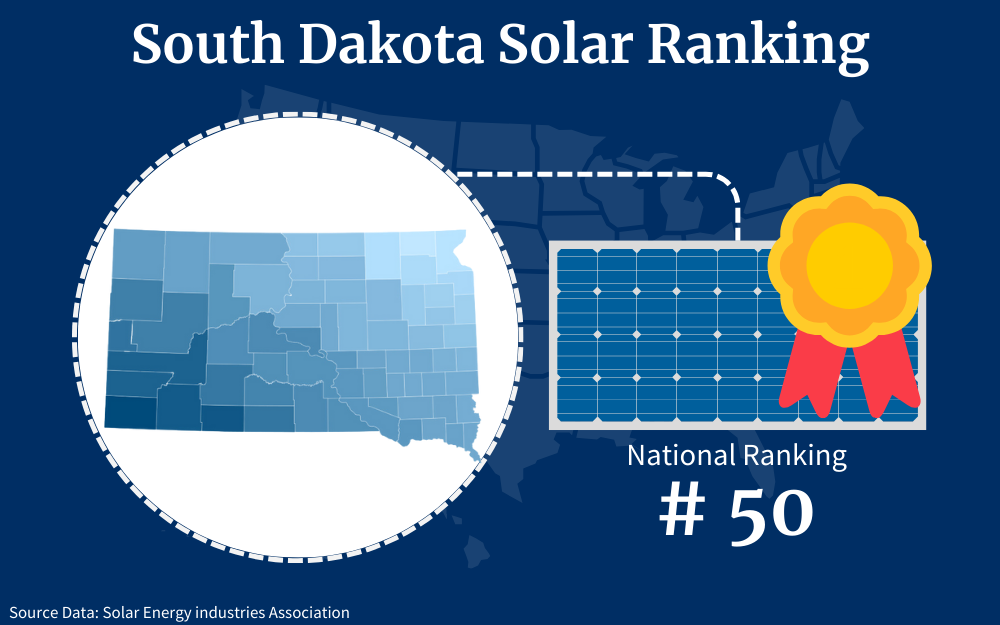

Since SD is last in the country in overall solar implementation, you can truly get in “on the ground floor”.3

Solar energy has become 90% more affordable since 2009.4 Competition and renewable energy initiatives at the government level, like South Dakota solar incentives, will conceivably continue to soar overall.

For example, currently, roof tiles designed for solar generation are available.5 They’re not yet properly affordable for average homeowners, but they do exist. As solar efficiency continues to compound, more options like these will develop.

An array in a market where such energy has increasing demand represents an investment with a higher likelihood of providing an increased return. Since SD is trailing everywhere else, you can get ahead of the trend in this state.

This guide explores what solar will cost in SD, how to calculate associated costs, what sort of incentives are available, and how you can take advantage of them by registering online.

Solar Panel Tax Credits in South Dakota

For average residents in the state, there are 3 main South Dakota solar incentives that exist under a solar stimulus program designed to reduce the cost of solar panels in South Dakota. These include:

- The Investment Tax Credit (ITC)

- The Production Tax Credit (PTC)

- Property Tax Exemption Up to $50,000 or 70% of System Cost

The federal ITC option allows you to claim 30% of the cost of installation on your federal tax return, and property tax exemptions allow you to add $50,000 or 70% of system cost to property value without accruing additional tax liability. The PTC option is really for larger solar installations.

The Investment Tax Credit (ITC)

As one of many government solar incentives, the ITC helps reduce tax burdens substantially. If a solar array costs $40,000, you could claim $12,000 as a federal tax credit.6 In South Dakota, the average household income is a little over $83,000.7 The 2023 standard deduction ranges from $13,850 to $27,700, depending on if you’re filing singly, jointly, or as the head of a household ($20,800).8 The total average state wage for SD, as of 08/23, is $49,890.9

This will differ from income for several reasons; sometimes more than one earner lives in a household, etcetera. Most SD residents will be in the 12% tax bracket at $11,001 to $44,725, or the 22% range at $44,726 – $95,375.10 These variables help plot a reasonable ITC savings expectation.

A single earner making $49,890 immediately drops to the 12% tax rate after the standard deduction. With the 30% ITC option at $12,000, that earner would be looking at a total taxable income of $28,540. At 12%, that comes to $2,884.80. Without an ITC deduction, that would be $4,324.80; so in this instance, it saves $1,440.

Someone filing as a married couple with an average combined household income of $83,000 would see their tax responsibility drop down a tax bracket by adding a $12,000 solar array. A $27,700 standard deduction and a $12,000 ITC deduction drop liability from $83,000 to $43,300, for a tax bill of $5,196. Without the $12,000 ITC deduction, the tax burden would be $12,166. In this instance, solar installation cuts $6,970 from annual taxes. If ITC options from installing a panel change your tax bracket, that alone is a notable incentive.

To apply for ITC, fill out an IRS Form 5695 (folloiwng the simple Form 5695 instructions) and include that with your annual tax paperwork.11

The Production Tax Credit (PTC)

The Production Tax Credit is intended for business ventures. It pays 2.75 cents per kilowatt-hour (kWh) produced.12

The largest solar installation in South Dakota, Lookout Solar Park, is 140 megawatts (MW).13 Solar energy in megawatt-hours (MWh) will be about 4 times the size of the installation every day.14 Annually, that’s 204,400 MWh or a PTC deduction of $5,621,000.

By contrast, a system producing 14,400 kWh (or 1,200 a month) would only produce $396 a year in PTC credits. At 22% tax, you might save $87.12 a year for a 10 kW array. Most homeowners won’t really benefit much from PTC, it’s designed for commercial purposes. Businesses wishing to apply simply need to include an IRS Form 8962 with annual tax information.15

Property Tax Exemption Up to $50,000 or 70% of System Cost

If your solar array adds $50,000 to your property value, you won’t have to pay a penny of property tax. You are eligible for this exemption up to $50,000, or 70% of the total array’s cost.16 A $100,000 array would only add $30,000 taxable equity and $70,000 that’s non-taxable.

Property taxes in South Dakota average 1.08% a year.17 The average home is $297,041.18 Average SD property taxes for such a home are $3,208.04. A $50,000 solar array would make that liability $3,748.04. That would be an annual savings of $540 a year.

For a $100,000 solar array, without the exemption, the property would be valued at $397,041 for a $4,288.04 annual tax bill. With the exemption, you only pay $3,532.04, for a savings of $756 a year. You would still pay $324 more a year in property tax for such an array, but that is dwarfed by home equity.

Contact the Department of Revenue for South Dakota in order to be sure you qualify.19 In most cases, assessors simply won’t factor in renewable energy additions of $50,000 or under.

Renewable Solar Energy Credits From the Government

There aren’t specific renewable credits in South Dakota from the government. Except for net metering, property tax exemptions, and the federal ITC, credits will be specific to a given solar provider in or adjacent to the state. There are a few loan programs designed, primarily, for rural residents. The Office of Energy Efficiency and Renewable Energy (EERE) maintains contemporary information online.20 This section explores rural energy loan options for SD.1

Through the rural energy program, there is guaranteed loan financing in South Dakota. There are also grants; small rural businesses may also be eligible for these. There are options to apply for new equipment, new system loans related to productive infrastructure, equipment used in processing, and more. Much of this renewable incentive is unique to the applicant.

Applications are reviewed singly, approval is given based on specificity. There are several prerequisites. Only 2 types of applicants will be approved:

- Agricultural Producers

- Small Businesses

Agricultural producers must produce agricultural products comprising 50 percent or more of the total annual income. Small businesses must be in the right rural areas of the state. They also must be private entities designed for profit (including partnerships, corporations, or sole proprietorships), cooperatives (501(c)12 cooperatives are eligible), electric utility companies (including tribal electric groups) that service rural clientele and aren’t government-run, or other tribal corporations and business entities as classified under the IRA (Indian Reorganization Act), Section 17. Also, small business administration standards as expressed by 13 CFR 121 must be maintained to qualify. Last, there can be no outstanding judgments, debts, delinquent federal taxes, or anything of the kind.

Rural businesses and agricultural operations can apply for guaranteed loans. Borrowers must be U.S. citizens, and able to demonstrate funds will not be spent outside the country. A rural area in SD is defined under this loan and grant program as one with under 50,000 residents. This link shows territorial eligibility across the Mount Rushmore state.21 If approved, loans cover up to 75 percent of project costs. Grants will cover half of the project costs.

In many situations, loans and grants are combined to cover a total cost of 75 percent. Loans approved by the end of 2023 can receive up to an 80 percent guarantee. Loan terms are individual to associated clients, including interest rates, and whether they’re fixed or variable. If applying for a grant, rather than a loan, you need to prove available funds to match the other half of the grant. To apply for such opportunities, this link has contact information.22 You’ll need to discuss your specific situation with associated personnel to determine funding options for you specifically.

How Much Do Solar Panels Cost in South Dakota?

The average cost of solar panels in South Dakota is $2.39 per Watt.23 In this section how to determine total costs is discussed for a clearer perspective on what total expenses will be, and where you stand to save.

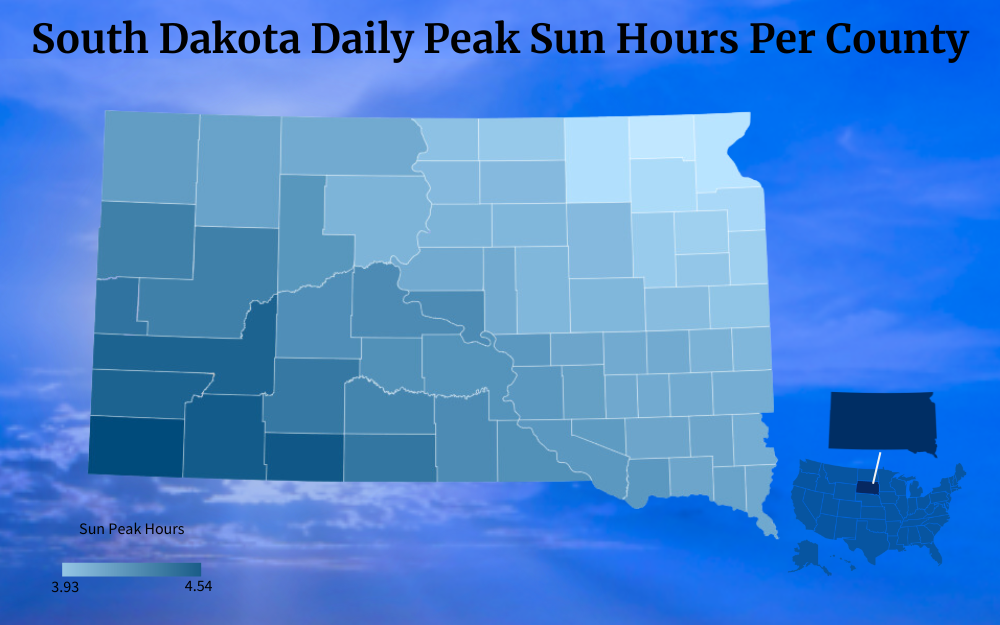

Determining the Panels You’ll Need, and Their Electricity Production

First, determine how many panels you’ll need. Several variables define this figure: energy needs and roof space. In 2023, South Dakota residents will pay approximately 11.75 cents per kWh.24 At an average monthly usage of 1,037 kWh, that’s a rounded figure of $121.85, or $1,462.20 annually, on average. Divide 12,444 kWh used annually by 365 days for a daily need of 34.09 kWh. Panels produce about 4 times their array’s size in kWh output on average. So to achieve 34.09 kWh a day, you’ll need approximately 8.53 kW in your array. This has been rounded up to 9 kW. For a 9 kW system, you need about 30 panels at 300 Watts.

Panels tend to be about 39 inches by 65 inches or 3.25 feet by 5.42 feet. Call it 18 square feet for ease of calculation, and to provide a cushion for error. Multiply that by 30 panels at 300 Watts, and you’re looking at 540 square feet of space necessary. That’s a square room 23 feet and 3 inches on one side.

That does bring up a mitigating factor. Adjustable mounts increase solar efficiency by 40%, allowing you to reduce the need for panels without losing energy production capability.25 A 9 kW system can be condensed to a 5.4 kW array. A mounting system capable of supporting up to 1,170 kW could be acquired for $560.26 That’s a variable price, for now, it’s a fine baseline. Also, in this specific instance, panels would need to be acquired that match said mount system. That said, comparable options should exist for whatever panels you decide to use. The cost in this scenario would be $2,584.62 for mounting equipment that would support a 5.4 kW array in SD. Call this price $2,600 for ease of calculation as you estimate final costs.

Expect an average solar array that will cover average electric needs in South Dakota to cost $15,490.62. With 6.4% sales tax, that becomes $16,482.01. Round up for budgeting efficiency and call it $16,483. That will net you 5,400 Watts (5.4 kW), and 9 kW of productive capability for an average of 12,000+ kWh a year, and over 34 kWh a day. You’ll only need 324 square feet of space for such an array (because it’s 40% smaller than the same array without mounts), it can be square or rectangular depending on needs, and adjustable ground-mounts are desirable for maintenance and repair.

If you don’t want to go with adjustable mounts, the same amount of production would cost approximately $22,886.65, call it $22,887. It would require 30 panels and approximately 540 square feet.

Both figures assume professional installation. Going the Do It Yourself (DIY) route, the average cost per Watt for solar is $1 to $1.50, excluding adjustable mounts.27 That means you could install a 9 kW array for $9,000 to $13,500, or a 5.4 kW array for $5,400 to $8,100; or $8,000 to $10,700 including the adjustable mount. There are 2 real downsides to going the DIY route: you have no warranty, and you’re likely not going to be eligible for net metering benefits.

Likewise, low cost solar panels or used pv cells will not have the lifespan to get a good ROI.

Most utility companies will require certified electricians to install an array to provide net metering credits.

Savings You Can Expect Through South Dakota Solar

Direct savings can be experienced in utility expense reduction over time. Indirect savings come from tax incentives and the like. Here, examination of grants or loans will be excluded, as they are idiosyncratic to a particular need. Savings will be calculated assuming a non-DIY approach, and adjustable mounts. The figure used is the average, of $16,483, including sales tax.

For a $16,483 expense, you can claim 30% of the cost with the ITC option, allowing $4,944.90 in deductions, or a reduction from $49,890 to $44,945.10 for the average SD resident. With a $13,850 average standard deduction, tax liability in the year you install will be $3,731.41. That’s down from $4,324.80, meaning a first-year ITC savings of $593.39.

If your income is in the $52,000 to $54,000 range, adding solar at an average cost could drop you from the 22% tax bracket to the 12% tax bracket, which will save you thousands more. The number used to calculate final savings here will assume South Dakota residents are in the average range, therefore final savings with the ITC will be about $593.39 on average in the first your you install solar.

With an average property value of $297,041, and property taxes averaging 1.08%, if the solar array you install added its own value to that of your property, you would be looking at $313,524. The property tax exemption would save you about $178 a year.

Energy costs for the year will be $1,462.20 on average, you’ll save that in your first year and going forward.

Lastly, there is the potential for net metering in South Dakota, but it’s only available from specific utility companies and isn’t mandated by law. Rates vary.28 What most utility companies do is credit you back for the cost of a kWh in your state. In South Dakota, that’s 11.75 cents. So if you produced 100 kWh a month over need, or 1,200 a year, savings would be $141; that is usually administered in energy bill credits. Your excess will be, on average, between 25% and 100% of that number, so here the assumption will be $88.13 in potential net metering benefits.

Breaking Down All Factors

Here’s what the savings breakdown looks like:

- $88.13 a year in net metering (potentially)

- $1,462.20 a year in average energy cost deferral.

- $178 a year in property tax savings

- $593.93 in ITC savings

Subtracted from $16,483, that’s a first-year savings of $2,322.25, for a final out-of-pocket expense of $14,160.75. After that, you should have an average annual savings of $1,640.20 to $1,728.33 (depending on net metering). At that rate, your solar array will pay for itself in 8.19 to 8.63 years. After that, said array generates $1,640.20 to $1,728.33 in value annually.

Your property should be at least $16,483 more valuable, and likely more, as South Dakota is new to solar. If you include equity expansion for the year when you install, an average South Dakota solar array should increase your net worth by your incentive savings, or about $2,322.25. As in: if you installed a solar array and sold your home in that year, you would see a somewhat indirect return of $2,322.25. If you didn’t sell, in a little over 8 years, you would see direct annual profit.

Net Metering Explained

Power Purchase Agreements, or PPAs, are usually what defines net metering. Without any specific law in South Dakota, net metering rates vary per utility company. Generally, the credit you get is about what the average cost of a kWh would be, which in SD is 11.75 cents. If you can find such an arrangement, don’t expect it to be much higher. Ask your specific utility company to see if they offer net metering. If they don’t, ask who does in your area. This will differ across the state.

What Is Needed To Qualify for Solar Credits?

Solar credit qualification in South Dakota is mostly a matter of filing the proper paperwork. Equity enhancement will be applied automatically up to $50k or 70% of a system’s added value, whichever is higher. For ITC and PTC credits, just include the proper tax form when you file. Net metering differs per utility company. Loans and grants are subject to application and approval based on your specific rural situation, contact appropriate agencies here.22

How To Choose Solar Panels in SD

There are 15 solar energy companies in SD.29 If you use your own energy needs to establish a baseline, and spend a half hour on the phone with each other, you’ll know all the opportunities available to you (beyond DIY) inside a regular work day (7.5 hours).

Read online reviews. Contact reviewers and households that have adopted solar whom you can question. Once you know what to expect, make yourself a list of important points to address, contact each company, and keep a tally of pros and cons. Some companies offer rebates, some don’t. Some have maintenance packages. When finished, compare associated advantages and determine which company offers the greatest value specific to your situation at the least cost.

Solar in South Dakota: It Can Be Worth It

If you have $17,000 in liquid assets, you’ll spend just under that installing a solar array for your solar panels for home systems, and see around $2,300 in benefits by year’s end. Within 9 years, you’ll have it paid off, and the equity will remain with your property.

Without that kind of money, if you’re in a rural community, there may be loans or grants available–if you’re running an eligible small business or an agricultural operation. Also, you may be able to secure a regular loan from a bank paid back at a rate under your energy bill for the solar array. If you go that route, it’s like you’re switching an energy bill for a loan payment, but your monthly budget doesn’t change.

Whatever the case, making the solar upgrade in South Dakota is profitable; you simply want to plan for long-term returns on your investment and take advantage of the South Dakota solar incentives to see maximal results.

Frequently Asked Questions About South Dakota Solar Incentives

Are Solar Panels Worth Exploring in South Dakota?

The answer to this is subjective, but if you go strictly by the numbers, for most long-time residents, it’s going to be a “yes”. The average home will increase in value at a rate greater than solar investment, and within 9 years, your array will start producing savings in excess of installation cost. Plus, South Dakota is last in the nation for solar, meaning you’ve got an opportunity to truly “get in on the ground floor”, and experience collateral benefits.

Do Solar Panels in South Dakota Work Through the Winter?

Yes, solar panels will work in South Dakota during the winter, but it’s important to construct either adjustable ground mounts or roof-based panels that will withstand the state’s exceptional wind. It’s best to work with professional installers. Ground-mounting panels can be wise for maintenance; some regions of SD get feet of snow in just hours’ time, so if you can clear off panels quickly after the primary storm, that can be key.

What is the Largest Solar Energy Array in South Dakota?

Lookout Solar Park is a solar installation just outside Rapid City that’s 140 MW in size.13

References

1U.S. Department of Agriculture. (2021, May 20). Rural Energy for America Program Renewable Energy Systems & Energy Efficiency Improvement Guaranteed Loans & Grants in South Dakota. USDA | Rural Development. Retrieved September 20, 2023, from <https://www.rd.usda.gov/programs-services/energy-programs/rural-energy-america-program-renewable-energy-systems-energy-efficiency-improvement-guaranteed-loans/sd>

2Smith, J. (2023, September 6). South Dakota Solar Incentives: Tax Credits & Rebates Guide 2023. SaveOnEnergy. Retrieved September 20, 2023, from <https://www.saveonenergy.com/solar-energy/south-dakota/>

3Schoeck, M. (2023, February 22). 50 states of solar incentives: South Dakota. pv magazine. Retrieved September 20, 2023, from <https://pv-magazine-usa.com/2023/02/22/50-states-of-solar-incentives-south-dakota/>

4Naseer, Y. (2023, January 17). Solar Is Officially the Cheapest Energy Source — Why Isn’t It Everywhere? Medium. Retrieved September 20, 2023, from <https://medium.datadriveninvestor.com/solar-is-officially-the-cheapest-energy-source-why-isnt-it-everywhere-6c8d251238b6?gi=03c986be4a4f>

5Zito, B. (2023, March 16). The Only Solar Shingles Buying Guide You Need. Forbes | Home. Retrieved September 20, 2023, from <https://www.forbes.com/home-improvement/solar/solar-shingles-buying-guide/>

6Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved September 20, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

7Point2. (2023). South Dakota Demographics. Point2. Retrieved September 20, 2023, from <https://www.point2homes.com/US/Neighborhood/SD-Demographics.html>

8Internal Revenue Service. (2022, October 18). IRS provides tax inflation adjustments for tax year 2023. IRS. Retrieved September 20, 2023, from <https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023>

9Wong, B. (2023, August 23). Average Salary by State In (2023). Forbes | Advisor. Retrieved September 20, 2023, from <https://www.forbes.com/advisor/business/average-salary-by-state/>

10Parys, S., & Orem, T. (2023, August 2). 2022-2023 Tax Brackets and Federal Income Tax Rates. NerdWallet. Retrieved September 20, 2023, from <https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets>

11Internal Revenue Service. (2022, December 6). Residential Energy Credits [PDF]. IRS. Retrieved September 20, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

12Solar Energy Technologies Office. (2023, August). Federal Solar Tax Credits for Businesses. Office of Energy Efficiency & Renewable Energy. Retrieved September 20, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

13U.S. Department of Transportation. (2023). Project Profile: Lookout Solar Park Project on the Pine Ridge Indian Reservation, South Dakota. U.S. DOT. Retrieved September 20, 2023, from <https://www.fhwa.dot.gov/ipd/project_profiles/sd_lookout_solar_park_project_pine_ridge.aspx>

14NRG Clean Power. (2023, March 31). How Much Does a 10kW Solar System Cost? NRG Clean Power. Retrieved September 20, 2023, from <https://nrgcleanpower.com/learning-center/how-much-does-a-10kw-solar-system-cost/>

15Internal Revenue Service. (2022, November 22). Premium Tax Credit (PTC) [PDF]. IRS. Retrieved September 20, 2023, from <https://www.irs.gov/pub/irs-pdf/f8962.pdf>

16Solar Reviews. (2023). Summary of South Dakota solar incentives 2023. SolarReviews. Retrieved September 20, 2023, from <https://www.solarreviews.com/solar-incentives/south-dakota>

17Smart Asset. (2023). South Dakota Property Tax Calculator. SmartAsset. Retrieved September 20, 2023, from <https://smartasset.com/taxes/south-dakota-property-tax-calculator>

18Clever Real Estate. (2023, September 1). South Dakota Real Estate Market in 2022: Forecasts + Trends. Clever. Retrieved September 20, 2023, from <https://listwithclever.com/real-estate-blog/south-dakota-real-estate-market/>

19South Dakota Public Utilities Commission. (2023). Renewable Energy and Energy Efficiency Tax Incentives. South Dakota Public Utilities Commission. Retrieved September 20, 2023, from <https://puc.sd.gov/energyefficiency/>

20U.S. Department of Energy. (2023). Office of Energy Efficiency & Renewable Energy Home Page. Department of Energy. Retrieved September 20, 2023, from <https://www.energy.gov/eere/office-energy-efficiency-renewable-energy>

21U.S. Department of Agriculture. (2023). OneRD Guarantee Loan Initiative. USDA | Rural Development. Retrieved September 20, 2023, from <https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=ONERD>

22U.S. Department of Agriculture. (2023, August 23). Rural Business-Cooperative Service State Energy Coordinators. USDA Rural Development. Retrieved September 20, 2023, from <https://www.rd.usda.gov/sites/default/files/RBS_StateEnergyCoordinators.pdf>

23Neumeister, K. (2023, September 8). Solar Panel Cost in South Dakota (2023 Local Savings Guide). EcoWatch. Retrieved September 20, 2023, from <https://www.ecowatch.com/solar/panel-cost/sd>

24Warren, T. (2023, June). Average Electricity Bills in Every State [Ranks for All States + DC]. EnergyBot. Retrieved September 20, 2023, from <https://www.energybot.com/blog/average-electricity-bills-in-every-state.html>

25Wynn, J. (2016, February 1). RV Solar Tilting: Is It Really Worth It To Tilt The Panels? Gone With the Wynns. Retrieved September 20, 2023, from <https://www.gonewiththewynns.com/tilt-rv-solar-panels>

26Eco-Worthy. (2023). Dual Axis Solar Tracking System with Solar Tracker. eco-worthy. Retrieved September 20, 2023, from <http://www.eco-worthy.com/pages/dual-asix-solar-tracker>

27Hyder, Z. (2023, January 12). DIY solar panels: Pros, cons & 6-step cost savings guide. SolarReviews. Retrieved September 20, 2023, from <https://www.solarreviews.com/blog/pros-and-cons-of-buying-diy-solar-panels>

28South Dakota Public Utilities Commission. (2021, August 20). Solar Energy Basics. South Dakota Public Utilities Commission. Retrieved September 20, 2023, from <https://puc.sd.gov/Publications/solarfaq.aspx>

29Simms, D. (2023, September 6). Top 4 Best Solar Companies in South Dakota (2023 Reviews). EcoWatch. Retrieved September 20, 2023, from <https://www.ecowatch.com/solar/best-companies/sd>

30Solar cell panels at D.C. Booth Historic National Fish Hatchery & Archives in Spearfish, South Dakota Photo by Mr. Satterly / WTF Public License Version 2. Resized and Changed Format. From Wikimedia Commons <https://commons.wikimedia.org/w/index.php?curid=82072819>